In today's global economy, supply chains are the backbone of many businesses. From sourcing raw materials to delivering finished products, the intricate web of suppliers, manufacturers, and distributors plays a critical role in a company's success. However, managing the financial aspects of a supply chain can be complex and challenging. That's where supply chain financing comes into play. In this blog, we'll dive into the world of supply chain financing and explore how it works.

What is Supply Chain Financing?

Supply chain financing, also known as supplier

finance or reverse factoring, is a financial strategy that facilitates the

smooth operation of supply chains by optimizing the flow of funds among

suppliers, buyers, and financial institutions. It is a mutually beneficial

arrangement that enables suppliers to access early payment for their invoices

and buyers to extend their payment terms.

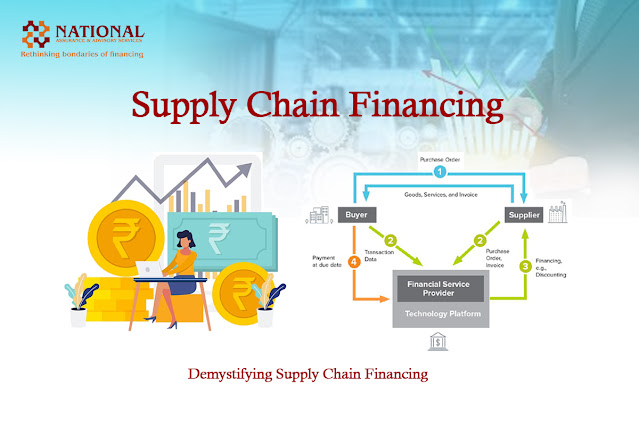

How Does Supply Chain Financing Work?

A buyer and a supplier must first agree to take

part in a supply chain financing programmed for the process to start. In this

process, financial institutions, frequently banks or specialized supply chain

finance providers, are essential.

As normal, the supplier provides the customer

with the requested goods or services and creates an invoice for the

transaction. The buyer signs the invoice, attesting to the accuracy of the

supplies or services acquired.

The supply chain finance programmed gives the

supplier the ability to ask for early payment for the authorized invoice. The

financial institution running the programmed receives this request.

Benefits of Supply Chain Financing:

- Supply chain financing allows suppliers to receive early payments, helping

them manage their cash flow more effectively.

- Buyers can negotiate better

terms with suppliers and build stronger, more collaborative relationships.

- By ensuring suppliers are paid

promptly, supply chain disruptions due to financial instability are

minimized.

- Buyers can optimize their

working capital by extending payment terms without adversely affecting

suppliers.

- Suppliers can often secure

financing at better rates through supply chain financing programs compared

to traditional loans.

Supply chain financing is a win-win solution for both buyers and

suppliers. It streamlines the financial aspects of supply chain management,

ensuring that the flow of goods and money remains uninterrupted. As businesses

continue to expand globally and face increasing competition, understanding and

implementing supply chain financing can provide a significant competitive

advantage. By creating more stable and efficient supply chains, companies can

focus on what they do best: delivering quality products and services to their

customers.

No comments:

Post a Comment